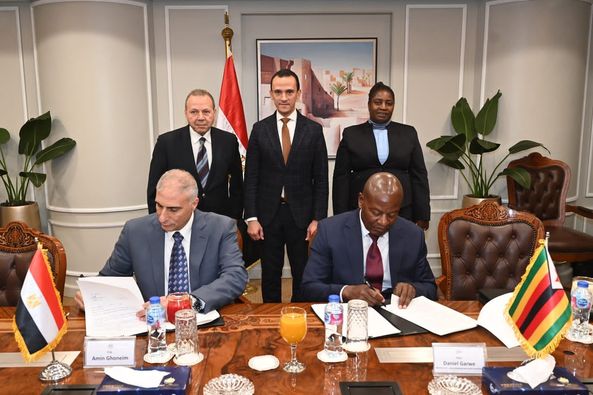

After spending more than US$1 billion to acquire mining sites in Zimbabwe over the past two years, massive Chinese investment could help catapult Zimbabwe to become the world’s fifth biggest primary producer of the material that’s vital to battery electric vehicles and the green revolution, mining consultancy CRU said.

The investments by Chinese companies, including Zhejiang Huayou Cobalt, Sinomine Resource Group, Chengxin Lithium Group and Yahua Group, could boost capacity to 192,000 tons of lithium carbonate equivalent (LCE) per year of petalite and spodumene in 2027, from 13,000 tons LCE per year in 2022, Cameron Hughes, a battery markets analyst at CRU said in a report. “These investments will place Zimbabwe as the fifth largest primary producer of lithium by 2025, after Argentina, contributing more than either Canada or Brazil,” Hughes added.

Investments by Sinomine and others mean Zimbabwe’s capacity could rise to about 11% of global LCE production in five years from just 2% in 2020, said Martin Jackson, head of battery raw materials at CRU. Still, while the capacity is “significant”, full utilization would depend on lithium demand and prices, Jackson added.

As nations seek to cut their carbon footprints, demand has surged for clean energy, fueling global competition, China has been laser-focused on the task of securing critical minerals for climate-friendly power sources like batteries. Lithium — known as “white gold” — is an essential raw material for the lithium-ion rechargeable batteries that power electric vehicles and in solar panels that store solar energy. Several Chinese companies recently making multimillion-dollar acquisitions to secure lithium supplies in Zimbabwe has improved the South African country’s economic fortunes. Last year, Zimbabwe banned exports of raw lithium ore, forcing companies to set up local factories to process ore into concentrates before export.