Morocco plans to increase the budget for health, education and social safety nets next year but expects the budget deficit to be reduced thanks to an increase in tax revenue, reads the 2023 draft budget.

The budget plans to increase in the next four years taxes on companies exceeding 100 million dirhams in annual profits.

Banks and insurers in particular will have to pay a 40% tax on profit by 2026, the finance minister has announced as part of a tax reform that will be launched under the 2023 budget.

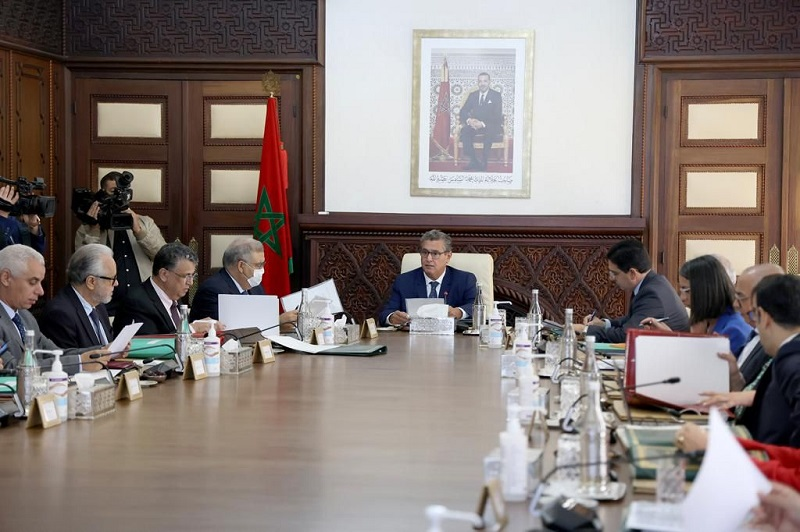

Taxes on sugary products will also be raised, said the finance minister who was presenting the headlines of the budget last week at the parliament.

Morocco subsidizes sugar along with cooking gas and flour. But this year, it has offered subsidies to professional transporters to keep prices stable as well as to farmers and tourism businesses to help them redress from the fallout of the pandemic.

Overall, spending on subsidies is expected to soar to some $4 billion including 3.2 billion for the subsidies fund (cooking gas, flour and sugar).

The Casablanca Finance City will also have to prepare for higher taxes along with free economic zones as Morocco pushes to align itself with tax transparency criteria to evade grey lists.

Meanwhile, the finance minister said that the income tax on the middle class and pensioners will be reduced.

These measures will help reduce the fiscal deficit from 5.3% in 2022 to 4.5% next year.

The government has also earmarked 300 billion dirhams for public investments.

The Moroccan king has urged the government to attract 550 billion dirhams in investments to create 500,000 jobs by 2026.