The Arab Monetary Fund has extended Morocco a new $211 million loan, within the framework of the Structural Adjustment Facility, to support a reform program in the public finance sector, the Arab financial institution announced in a statement released Friday.

The Arab Monetary Fund has extended Morocco a new $211 million loan, within the framework of the Structural Adjustment Facility, to support a reform program in the public finance sector, the Arab financial institution announced in a statement released Friday.

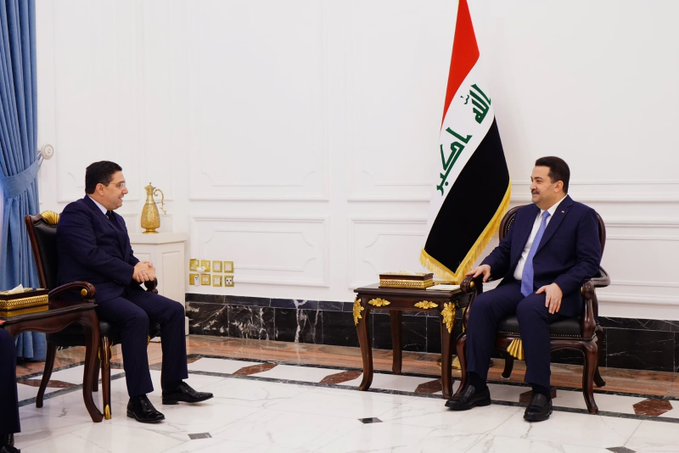

The loan agreement was signed on May 23 by Morocco’s Economy and Finance Minister Mohamed Benchaaboun and the General manager and Chairman of the Fund’s Board of Executive Directors, Abderrahman ben Abdellah Al Hamidi.

Earlier in May, precisely on May 7, the AMF had provided an Automatic Loan to Morocco worth $127 million.

According to the AMF statement, the loan amount, withdrawn on May 20, 2020, was meant to support the Kingdom’s external financial position, and meet emergency needs amid the global COVID-19 crisis.

The AMF also announced on Friday it has extended Tunisia, within the framework of the Structural Adjustment Facility, a new loan worth $98 million to support a reform program in the financial and banking sector.

The loan agreement, signed on May 29, follows another $59 million loan that was signed on May 20 and withdrawn on June 3. The amount was destined to support the country’s external financial position, and meet emergency needs.

The Arab financial institution emphasized its commitment to continue to provide financial and technical support to its member states and assist them face up the COVID-19 crisis, and its keenness to support their efforts to implement economic, financial and structural reforms, and confront various challenges.

“The AMF assistance in this regard comes as a support to the reform efforts of member countries and the measures they are taking to stimulate the economy and provide liquidity in order to contain the negative effects of the virus outbreak,” the statement explained.

The AMF said it is currently studying financing requests from other member countries, and is processing the requests through expeditious procedures, in order to provide support as quickly as possible, so that the borrowing member countries can meet financing needs and enhance their financial positions to face various challenges, especially in such times.