Morocco will launch two international bonds in 2020 and 2021 to lift its foreign exchange reserves and help the economy offset the fall in foreign currency in flow due to the coronavirus impact, governor of Morocco’s central bank Abdellatif Jouahri said

Morocco will launch two international bonds in 2020 and 2021 to lift its foreign exchange reserves and help the economy offset the fall in foreign currency in flow due to the coronavirus impact, governor of Morocco’s central bank Abdellatif Jouahri said

He said Morocco should tap into the bond market as long as conditions are propitious, noting that the bond sale “within days” will be in euros.

Previous media reports said Morocco will raise up to 1 billion euros from the international bond market.

Another bond sale is due in 2021, said the Governor, noting that Morocco should at all costs maintain its investment grade given by credit rating agencies to have better access to the bond market.

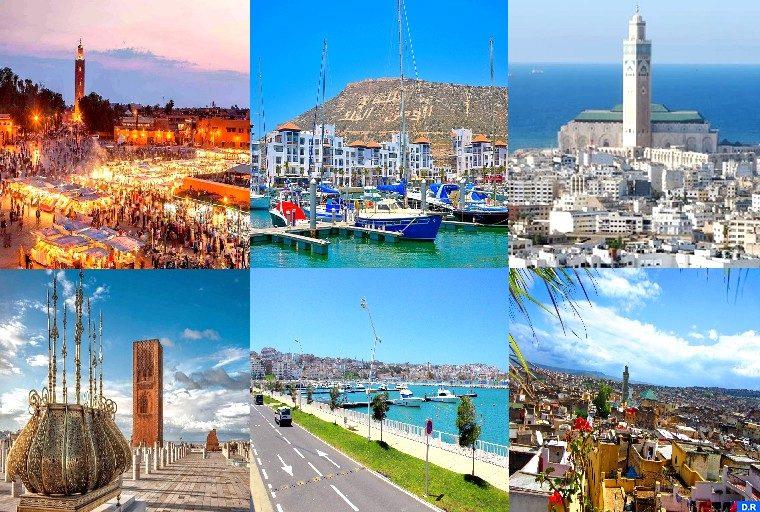

The bonds would offset a drop in foreign currency inflow from tourism, exports and foreign direct investment and would help bolster Morocco’s foreign exchange reserves seen by the bank at 294.7 billion dirhams ($32 bln) and 289 billion dirhams in 2020 and 2021 respectively, enough to cover a little more than 6 months of imports.

The bank, following its quarterly meeting, halted its monetary easing policy by keeping the benchmark interest rate at 1.5%. The rate was cut last June from 2% to help the economy recover from the impact of the coronavirus.

However, the bank said Morocco’s economy would contract by 6.3% instead of 5.2% as the anti-coronavirus restrictive measures continue to hamper the economy, notably tourism.

Growth is expected to recover to 4.7% in 2021 provided the pandemic is controlled and the agricultural added value improves.

These figures are shrouded in uncertainty given the lack of visibility over the coronavirus pandemic, said the governor, who maintained that the growth figures are more close to scenarios than accurate forecasts.