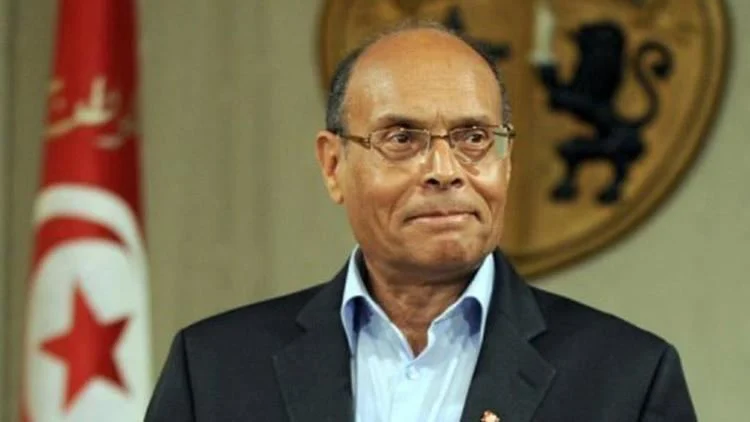

President Kais Saied urged lawmakers to end the independence of the monetary policy in the country by adopting a law that would allow the treasury to borrow directly from the central bank.

The move is the latest in a series of moves to concentrate all powers in his firm grip, after he sapped the democratic achievements of the Jasmine revolution setting the country on an authoritarian course.

The President has been ruling by decree, while using the judiciary to silence critics.

Saied wants the government’s budget to be funded directly by the central bank to avoid foreign debt and to cut interest rates.

Such a move would necessarily lead to money printing, a practice that would worsen inflation and social conditions in the cash-strapped country.

Saied had in December prompted a law that allowed the central bank to lend 2.2 billion dollars to the treasury to pay urgent bills.

As Tunisia struggles to gain foreign funding, the treasury opts for domestic debt which has already hit its limits.

Shunning painful reforms to curb spending, President Said rejected an IMF deal calling for subsidies’ cuts and a reform of public finances.

The $1.9 billion lifeline loan promised by the IMF and conditioned on reforms is now obsolete and needs to be updated in light of the deterioration of Tunisia’s public finances.

Without the IMF deal, rating agencies have been warning of risk of default as the country struggles to gain foreign debt to fund imports, leading to shortages of some basic goods.