The United Nations Conference on Trade and Development (UNCTAD) highlighted Morocco’s headway in the automotive sector and its growing exports that contrast with Algeria’s car industry debacle.

Using 2019 figures, UNCTAD showed in a detailed report how Morocco produced 403,218 vehicles compared to 60,012 in Algeria, which in 2020 had to halt production altogether.

“In Algeria, output virtually came to a halt in 2020 due to plant closures resulting from new regulations and a corruption controversy,” UNCTAD said in a footnote on page 83 of its report on Africa and technology-intensive supply chains.

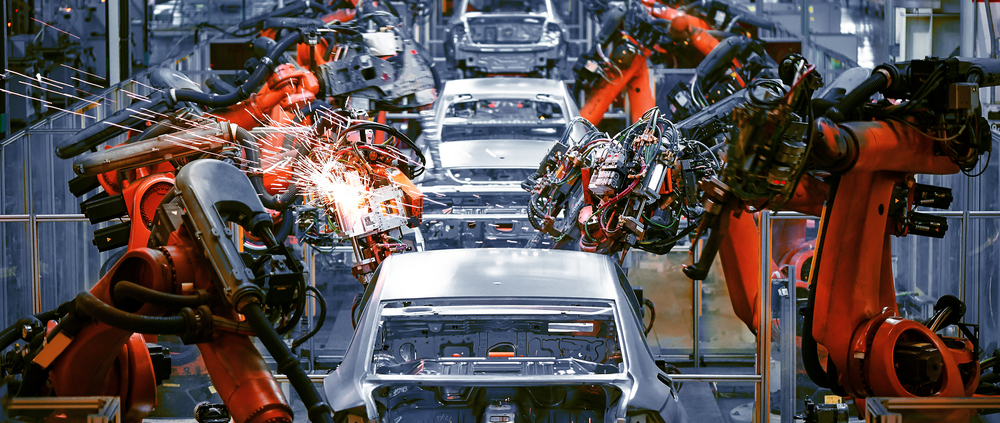

Morocco’s growing car industry

In comparison, Morocco’s increase in car production from 42,066 in 2010 to 403,007 in 2021 was driven by large investments in infrastructure as well as an attractive geographical location, a stable political and macroeconomic environment, and a national framework to support the automotive industry, the report said.

In 2022, Morocco’s car exports surged to $11 bln from $8.3 bln a year earlier. In 2021 alone, final vehicle exports stood at $3.4 billion as the automotive sector offers 220,000 jobs, the report showed.

With a local integration rate of 60%, Morocco has moved to manufacture technology demanding parts as it continues to attract suppliers such as German Motor Distributors, Snop (parts and components supplier), Stellantis Sumitomo Electric Wiring Systems (technical array of systems and components) and Yazaki (the world’s largest manufacturer of wiring harnesses).

“Manufacturing is moving towards more complex components with high value added, such as engine manufacturing, engineering, and research and development. Morocco also produces about 40,000–50,000 electric vehicles per year.”

“Renault, which has the largest assembly plant with a capacity of 400,000 units, exports most of its production. The Citroën Ami, made in Kenitra, Morocco, was the most widely sold vehicle in Spain in 2022,” the report said.

The report also highlights the growth of installed capacity to 700,000 vehicles as of 2020, with the aim to produce one million cars per year by 2025 and achieve a local integration rate of 80 per cent.

Algeria’s fiasco

The North Africa Post has previously shed light on Algeria’s failure to set up a competitive car industry. While that debacle was due to corruption and self-inflicted factors, Algeria still struggles to develop a car industry but it wants that fast and without meeting the prerequisite: an integrated industrial cluster or ecosystem of local part suppliers.

In 2019, after his election, Algerian President Tebboune had criticized car industry professionals in his country accusing them of practicing “disguised imports” due to the very low sourcing rate.

In October, he said Fiat would open an assembly plant in the country with the first cars to be produced as fast as March 2023. The date was put off to late 2023 by his industry minister.

The promise came amid a worsening shortage of cars in the Algerian market due to an import ban that lasted for 2 years until it was lifted last November.

Many plants had stopped, including Renault and Hyundai assembly plants, which were dedicated to supplying the local market.

Now, Tebboune wants exports as well in an Algeria that is punching above its weight, unable to carry out the required reforms.

Instead of a top-down approach, Algeria had better start with a bottom-up strategy that consists in encouraging entrepreneurship in its state-dominated and rent-based economy.

The lack of local companies that can supply car parts at competitive prices will continue to hamper any step to launch a car industry in the country.

The low percentage of locally produced parts in Algerian car assembly plants is reflective of a lack of action on the upstream to attract foreign parts suppliers and encourage local enterprises to operate in the sector.

The debacle of the car industry in Algeria is but a symptom of an aging, corrupt and authoritarian regime that has failed Algerian youth and put Algeria’s fragile finances on a perilous course that thwarts investors.