The Botswana government announced Monday that it will buy a 24% stake in the Belgian gem trader HB Antwerp, a move that is seen as a possible challenge to De Beers’s dominance of the southern African nation’s diamond industry.

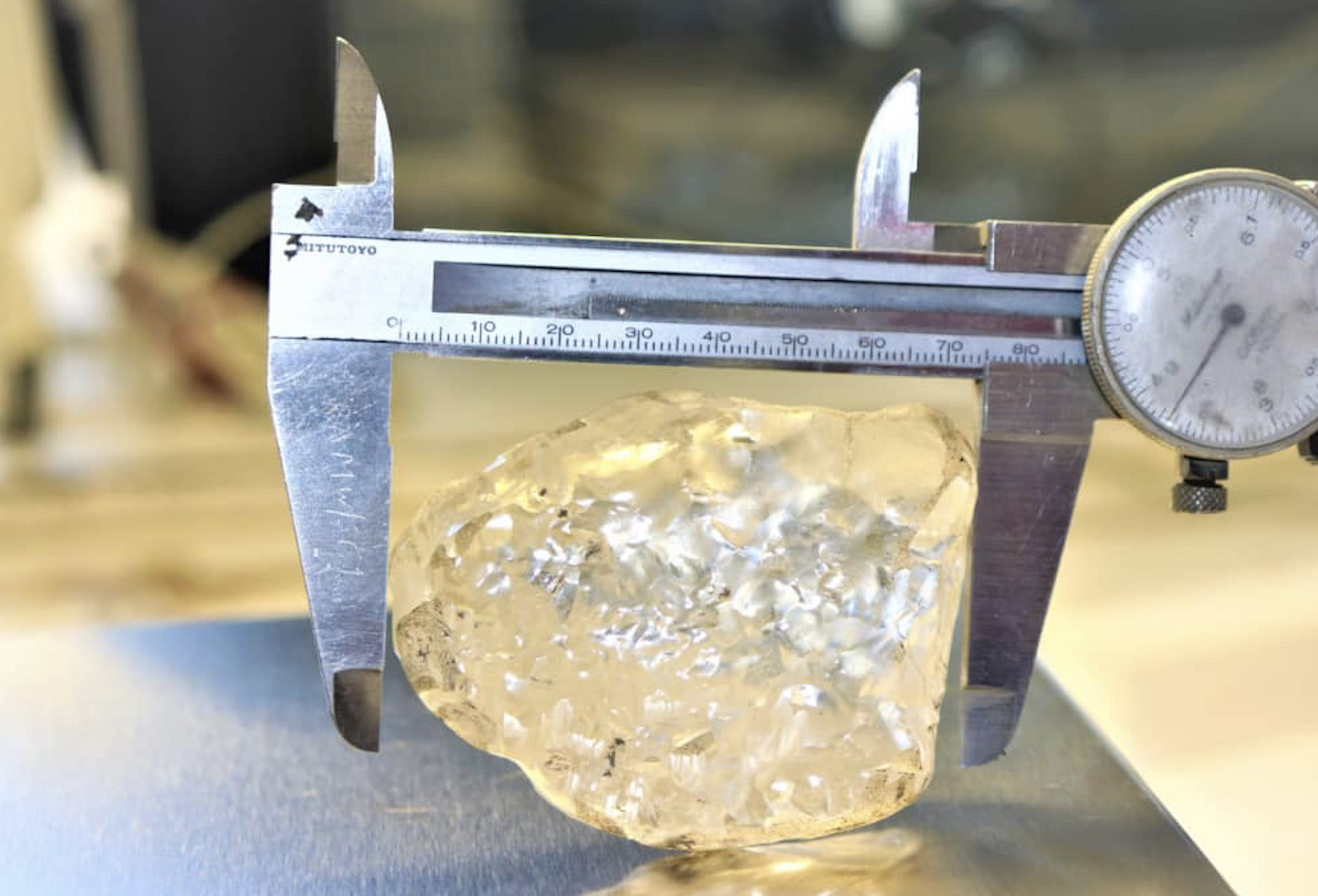

“Today is the dawn of a new era of a diamond industry in Botswana as we begin this journey with HB Antwerp,” President Mokgweetsi Masisi said at the official opening of the cutting and polishing facility in Gaborone. The high-profile deal, which Masisi referred to as “a game changer,” comes amid uncertainty over Botswana’s long-standing sales agreement with industry giant De Beers. The president also stressed that Botswana must gain more from its diamond resources, for the “simple reason that the returns that come with having control to sell our diamonds with value addition, are much, much, higher than the returns on the sales of rough diamond stones.”

According to Masisi, both parties “have agreed to a strategic partnership whereby the government of Botswana will invest in HB by acquiring a 24% equity stake in HB Antwerp.” No dollar figure for the total revenue expected to be generated from the 24% stake was given. Last month, the president indicated his unhappiness with a 54-year-old sales deal with De Beers that is due to expire on 30 June, in which Botswana is allocated 25% of rough diamonds mined under a joint venture. Botswana, which jointly owns Africa’s largest diamond producer Debswana with global giant De Beers, a unit of Anglo American, is moving to explore other options outside the partnership with De Beers — and the latest deal with HB Antwerp can be seen as part of the bigger picture. Masisi has even threatened to walk away from the talks if Botswana does not get a bigger share of Debswana’s output for marketing outside the De Beers system.