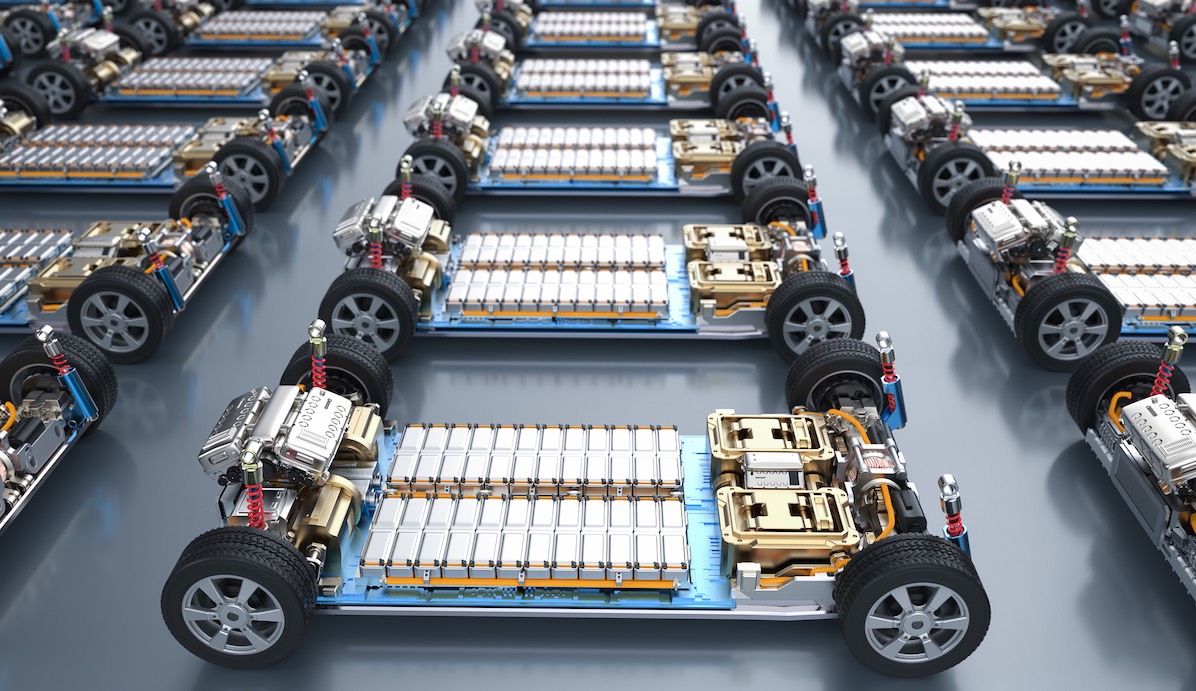

Morocco’s booming EV battery industry positions the country to become an export hub to the EU and the US by 2030, said a report commissioned by the UK government under its Manufacturing Africa program.

Morocco “could competitively produce and export LFP batteries to Europe by 2030 at USD 68-72/kWh. This could generate USD 10-15 billion annually and create 22,000-25,000 jobs, rivaling global manufacturers like China, Indonesia, Europe, and the US,” said the report dubbed “Africa’s Competitiveness in Global Battery Supply Chains.”

The report, presented by foreign secretary David Lammy, highlights the attractive investment climate in Morocco to global EV battery makers thanks to its expanding automotive industry and availability of raw minerals and refining industry of lithium, cobalt, phosphorus, and copper.

Morocco will also be home to Africa’s first gigafactory thanks to the country’s cathode production capacity, the report said.

The FTA with the US and proximity to Europe have also increased the attractiveness of Morocco to foreign investors in the EV battery industry.

In Africa, “only Morocco would produce cathode materials (i.e., cathode) required for battery manufacturing by 2030, thus any plant would need to either import from Morocco (only cathodes) or from other active materials-producing countries (e.g., China),” it said.

“Stable political economy, geographical proximity, duty-free exports to the EU/US and raw material reserves position Morocco as a hub for battery manufacturing in Africa,” the report adds, citing “multiple Chinese investments.”

“Morocco, with its automotive manufacturing industry, is a prime location for manufacturing,” it said.

“Despite higher production costs compared to China, Morocco and Tanzania would remain more competitive than the US, Europe, and Indonesia,” the report said.

In June, Gotion High Tech said it was building a $1.3 billion gigafactory in Morocco, with production planned in 2026.

The plant will be located in Kenitra and will start with a capacity of 20 gigawatts per hour and eventual capacity of 120 gwh.

In May, Chinese auto battery manufacturers Hailiang and Shinzoom announced two separate plans to produce copper and anodes respectively for a combined total nearing 1 billion dollars in Tanger Tech.

In April, BTR New Material Group signed a deal with the Moroccan government to set up a cathodes plant, critical to EV battery manufacturing.

In September last year, CNGR Advanced Materials partnered with Moroccan private investment fund Al Mada to build an electric vehicle battery plant in Jorf Lasfar worth 2 billion dollars.