The United States’ ambitions to de-risk its critical minerals from China’s supply chains may be complicated by Chinese control of cobalt and other resources from Africa, most notably the Democratic Republic of Congo (DRC), a new study finds.

The study, recently released by the London-based minerals research and pricing firm Benchmark Mineral Intelligence, found that 79% of the world’s supply of refined cobalt in 2024 will originate from assets that are either already classified as ‘foreign entity of concern’ (FEOC) or at high risk of becoming so, under the foreign entity clause in the US Inflation Reduction Act (IRA). “The majority of DRC volumes fall under the ‘high risk’ category, owing to high levels of Chinese ownership in assets in the country, and therefore are likely to be ineligible for consumer tax credits under the IRA,” said Will Talbot, research manager at Benchmark. “Over time, we do expect the share of material coming from high risk or FEOC countries will decline marginally as more ex-China supply comes online, but we forecast it to remain significant,” he said.

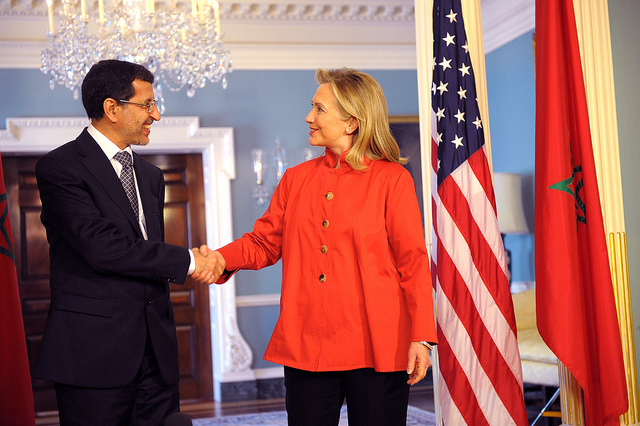

Most of the DRC’s cobalt, which is used as a crucial component in electric vehicle batteries and other electronics, is already controlled by Chinese mining companies. Benchmark’s study also noted that 60% of the global supply of mined cobalt in 2024 is expected to come from assets classified as FEOC or at “high risk” of becoming part of that category. Therefore, the analysis warns that China’s dominance in the resource-rich DRC may complicate Washington’s ambitions to de-risk its critical minerals from China’s supply chains. In response, the US has sought to challenge China’s grip on the critical minerals market by signing an MoU with Zambia and the DRC to bring funding and expertise into their mining industries and also by pushing ahead to revamp the Lobito railway corridor between Angola and Zambia through the DRC.